Broadcom Earnings — Broadcom's AI Infrastructure Kingdom Keeps Expanding

Forget chips—Broadcom’s infrastructure model blends software, custom silicon, and non-cyclical growth into a compounder

From the Wall Street Journal:

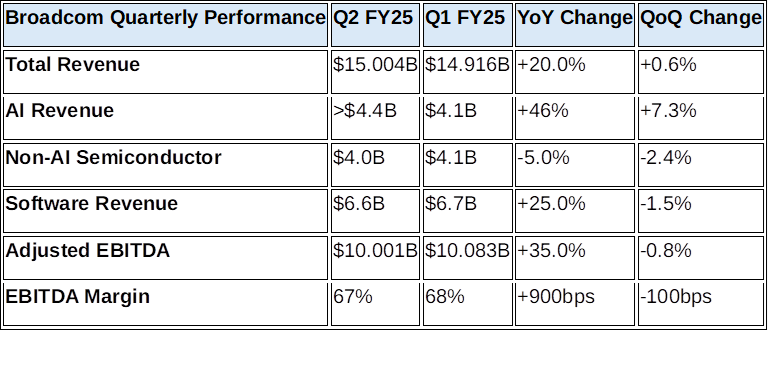

Broadcom Inc. reported record quarterly results for its fiscal second quarter, with revenue of $15.004 billion, up 20% YoY, driven by surging AI semiconductor demand and continued strength from its VMware acquisition. The chip giant's AI revenue soared 46% to over $4.4 billion while infrastructure software margins expanded to approximately 76%, beating analyst expectations across all segments.

My first thought reading these numbers wasn't about the beat—it was about the category error. The market is still pricing Broadcom like a cyclical semiconductor company when it's actually built the closest thing to an AI infrastructure utility that exists.

Broadcom trades like a mature semiconductor company. But consider what it's actually become:

· Utility-like customer lock-in through critical infrastructure control

· Software-like recurring revenue with 76% margins via VMware

· Platform-like network effects where customer scale increases switching costs

And yet it trades like a “mature semiconductor business.”

Broadcom’s moat is growing wider with every hyperscaler deployment — and when the market finally sees it for what it is, there’s a meaningful rerating ahead.

But there's a deeper story here about what Broadcom actually is: the ultimate financial engineering machine disguised as a tech company, and AI has become its most potent catalyst yet.

The AI Networking Stranglehold

Everyone obsesses over the GPU wars between NVIDIA and AMD, but here's what they're missing: Broadcom owns the layer that actually matters—the networking that stitches those compute islands together. AI networking revenue exploded 170% YoY and now represents 40% of total AI revenue.

When Hock Tan says customers are planning "1 million AI cluster deployments by 2027," he's not talking about product cycles. He's talking about infrastructure commitments with switching costs that compound exponentially. You don't rip out the networking fabric of a million-GPU cluster because you found a cheaper alternative.

"We anticipate now our fiscal twenty twenty five growth rate of AI semiconductor revenue to sustain into fiscal twenty twenty six." — Hock Tan

That's the language of a CEO who knows he's built something foundational, not cyclical. The newly announced Tomahawk 6 switch—102.4 terabits per second capacity enabling over 100,000 accelerators in just two network tiers—isn't an incremental improvement; it's architectural dominance that makes Broadcom indispensable to hyperscale AI deployments.

The China Calculus: The NVIDIA Comparison That Reveals Everything

Here's where Broadcom's position becomes fascinatingly counterintuitive relative to NVIDIA. While NVIDIA lost $8 billion in projected China revenue due to export restrictions, Broadcom's AI business accelerated. This isn't coincidence—it's structural advantage.

When customers are forced to build denser, more efficient clusters with constrained chip supply, Broadcom's networking infrastructure becomes more valuable, not less. If you can only get 70% of the GPUs you wanted, you better make damn sure they're connected optimally. Export restrictions don't hurt Broadcom's AI business—they increase the premium customers will pay for efficiency.

Tan's Q3 guidance tells this story: $5.1 billion in AI revenue represents 60% YoY growth, suggesting the business is actually accelerating through geopolitical headwinds rather than stabilizing. Meanwhile, the non-AI semiconductor business sits at $4.0 billion, down 5% YoY and described as "close to the bottom"—a stable floor while AI scales to dominance.

VMware: The Stealth Software Transformation

Here's what I find most interesting about the VMware integration: it's not just working, it's working ahead of schedule. Software revenue of $6.6 billion grew 25% year-over-year with operating margins hitting approximately 76%—that's a 1,600 basis point improvement from the prior year.

The subscription conversion is 87% complete among the top 10,000 customers, which puts Broadcom well ahead of their 18-month timeline. CFO Kirsten Spears noted that they have "another year plus, maybe a year and a half to go" for full conversion, but the trajectory suggests they'll beat that guidance too.

The slight quarter-over-quarter decline in software revenue reflects normal seasonality, but the year-over-year acceleration combined with margin expansion tells the real story: this is becoming a fundamentally different business.

The Financial Engineering Machine Revealed

What Broadcom has perfected isn't traditional tech innovation—it's "franchise value" identification and optimization. Tan's M&A strategy targets companies with sticky customer bases and under-monetized recurring revenue streams, then applies ruthless operational efficiency to convert them into predictable cash flow generators.

AI represents the perfect tailwind for this model: Broadcom didn't invent LLMs or create AI software stacks, but they're providing the critical "picks and shovels" that hyperscalers desperately need. This reduces speculative R&D risk while creating deep customer lock-in through co-development relationships.

The $7.0 billion returned to shareholders this quarter ($4.2 billion buybacks, $2.8 billion dividends) while continuing debt paydown isn't just capital allocation—it's Tan reloading the M&A cannon for the next large software acquisition. The subtext is clear: organic growth in non-AI segments isn't exciting enough to meet aggressive value creation targets.

The Hidden Vulnerability: Operational Rigor vs. AI's Innovation Pace

Here's the tension nobody's talking about: Broadcom excels at operational discipline and efficient execution—perfect for mature businesses. But leading-edge AI often requires flexible, risk-tolerant R&D culture to explore breakthrough architectures.

While their custom AI work with hyperscalers is highly focused, the broader AI landscape evolves at breakneck speed. If hyperscalers develop more in-house capabilities or disruptive architectures emerge from agile startups, Broadcom's highly structured model might struggle to pivot beyond optimizing customer-defined needs.

Their strength is scaling existing solutions, not speculative innovation. In a field where the next breakthrough could reshape everything, that's both an asset and a potential blind spot.

Strategic Implications: The Infrastructure Toll Road

Broadcom's core capability has always been identifying and dominating critical infrastructure chokepoints. What's different now is the symbiosis between their AI hardware and software businesses:

AI networking creates customer dependencies that compound over time. VMware generates the recurring cash flows that fund continued R&D and strategic acquisitions. Together, they're building something closer to infrastructure utility than traditional technology company.

The guidance for Q3 tells the story: $5.1 billion in AI revenue (60% year-over-year growth) on total revenue of $15.8 billion. When AI represents one-third of a $15+ billion quarterly revenue stream and continues accelerating, you're not participating in a trend—you're enabling it.

My prediction? The market will eventually recognize that Broadcom has built the most defensible position in AI infrastructure. The combination of networking lock-in, software recurring revenue, and margin expansion creates a business model that's fundamentally different from cyclical semiconductor companies. When that recognition happens, the rerating will be dramatic.

The only real risk is geopolitical—export restrictions could theoretically impact AI growth. But given that Broadcom's infrastructure becomes more valuable when customers need to maximize efficiency with constrained chip supply, even that risk seems manageable.

Broadcom isn't just riding the AI wave—it's become part of the ocean floor that everything else builds on top of.

#AVGO #AI #earnings #techstrategy #infrastructure #investing AVGO 0.00%↑ NVDA 0.00%↑ SMH 0.00%↑ SOXX 0.00%↑

Wow! What a great write up with fresh angles that few see coming!!