Credo's Connectivity Conquest - From Plumbing to Platform

Credo’s Platform Play in the AI Era—and the Multibillion-Dollar Shift from Chips to Smarts

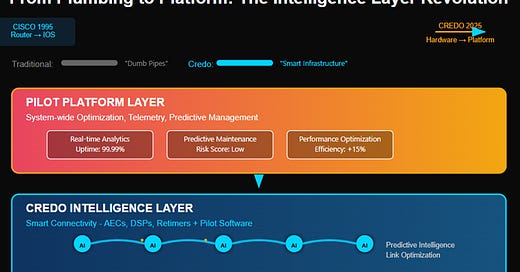

Opening Parallel: Cisco 1995 and the Pattern of Infrastructure Shifts

It's 1995. The commercial internet is a nascent, chaotic explosion of possibility. For most investors, Cisco Systems is a rapidly growing company selling "routers"—complex pieces of hardware that direct internet traffic. They make the boxes that connect the networks. A good business, certainly, but one fundamentally tied to hardware cycles and manufacturing economics.

The missed insight, however, was profound. Cisco wasn't just selling boxes; they were building the internet's nascent operating system. Their Internetwork Operating System (IOS) was the software intelligence that made sense of the chaos, enabling networks to scale, interoperate, and become reliable. As businesses digitized and networks became mission-critical, the intelligence embedded in IOS—its features, its stability, its management capabilities—arguably became more valuable than the physical routers themselves.

The result? Cisco's stock embarked on a legendary run from $1 to $80 (split-adjusted), transforming from a hardware vendor into the backbone of the digital age. Investors eventually realized they owned a piece of the internet's operating system, not just a supplier of its components.

Why now? Fast forward to 2025. AI infrastructure is hitting its own "Cisco moment." The demand for raw compute is insatiable, but the real challenge is making these massive, distributed AI factories work efficiently and reliably. And one company, Credo Technology Group, appears to be playing a strikingly similar game to Cisco—transitioning from a connectivity "plumber" to an intelligent platform provider.

The AI Infrastructure Bottleneck

Core Insight: AI isn't compute-bound anymore—it's connectivity-bound.

The AI clusters being built today by hyperscalers generate data flows that are, frankly, mind-bending compared to even a few years ago. We're talking about terabits per second moving between thousands of GPUs, requiring flawless, low-latency communication. OpenAI's GPT-4 training run required connecting 25,000 GPUs in a coherent cluster. Anthropic's Claude models demand even more.

But here's the thing—adding more GPUs to a training cluster doesn't just require more compute; it requires exponentially more connectivity between those GPUs. And the failure modes are brutal. In normal data center operations, if a network link fails, you route around it. In AI training, if any connection in the cluster fails, the entire training run—worth millions of dollars in compute time—comes to a halt.

The problem is that traditional interconnects, even advanced ones, often treat these critical links as "dumb pipes." They are designed to transport data, but not necessarily to intelligently manage, predict, or optimize its flow in the context of highly dynamic and incredibly expensive AI workloads.

The stakes are immense. Every broken link, every dropped packet, every moment of sub-optimal network performance doesn't just cause a flicker—it can halt multi-million-dollar training runs, degrade inference service quality, and waste precious GPU cycles. Uptime and efficient utilization are no longer just desirable; they are fundamental competitive advantages.

This reality dictates that connectivity itself must become intelligent, predictive, and deeply software-optimized.

Credo's Quiet Revolution

Core Insight: The market sees semis—but Credo is building a platform hidden inside hardware.

On the surface, Credo Technology Group (NASDAQ: CRDO) is a rapidly ascending semiconductor company, riding the AI wave with impressive numbers. Their fiscal year 2025 revenue hit $436.8 million, a staggering 126% year-over-year increase. Their guidance for FY26 is even more ambitious: revenue exceeding $800 million with a non-GAAP net margin approaching 40%.

These are figures that turn heads, driven by strong demand for their Active Electrical Cables (AECs), optical Digital Signal Processors (DSPs), and retimers—all critical components for high-speed data movement in AI systems. They are, by all accounts, solving real, acute pain points for hyperscalers. CFO Dan Fleming highlighted customer diversification improving from 86% concentration with one customer in Q3 to three customers representing greater than 10% of revenue in Q4.

But dig deeper into CEO Bill Brennan's commentary, and a more profound story emerges. The real strategic play, the quiet revolution Credo is spearheading, isn't just about faster chips or better cables. It's about their "Pilot" software platform, which Brennan describes as providing "predictive integrity, link optimization, and telemetry."

This language doesn't sound like typical semiconductor firmware; it sounds like the core of a sophisticated operational intelligence platform.

Every piece of Credo hardware deployed in a customer's AI fabric—every AEC, every optical module with their DSP, every retimer—effectively becomes an intelligent sensor node. These nodes feed data back into the Pilot ecosystem, allowing for system-wide visibility and control that is incredibly valuable. This isn't just about selling a product; it's about embedding an operational intelligence layer that becomes more valuable with each deployment.

When Brennan talks about Credo owning "the entire solution stack, service IP, retimer ICs, system level design, qualification, and production," he's not describing component sales. He's describing platform integration.

Business Model Shift: From Chips to Continuous Value

Core Insight: Hardware revenue is upfront. Platform value compounds.

The traditional semiconductor business model is well-understood: design a chip, manufacture it, sell it to a customer, customer deploys it, relationship largely ends until the next hardware refresh cycle. It's inherently cyclical and often subject to commoditization pressure over time.

Credo appears to be architecting a fundamentally different model—one with the potential for continuous value creation and deeper customer engagement:

· Traditional model: Design → manufacture → sell → deploy → wait for refresh cycle

· Platform model: Deploy connected hardware → continuously optimize performance → integrate into customer operations → create switching costs → expand relationship over time

The Pilot platform, with its promise of recurring optimization and enhanced reliability, creates what I would call operational lock-in. If a hyperscaler's AI cluster uptime and efficiency are significantly enhanced by Pilot's intelligent management of the physical links, the cost and risk of replacing Credo's integrated solution become substantial, even if a competitor offers cheaper or faster standalone components.

This shift is evident in their financial ambitions. A sustainable ~40% non-GAAP net margin target, as guided for FY26, is aggressive for a company perceived purely as a hardware vendor. Such margins become far more plausible if a significant component of the value delivered is driven by differentiated software and platform capabilities.

In this light, customer concentration—often seen as a risk—can be interpreted as evidence of depth of integration with key partners who are early adopters of this platform approach. When your largest customer represents 61% of revenue but is building critical operational dependencies around your platform, that's not just concentration risk—it's switching cost creation.

Why Broadcom Can't Copy This

Core Insight: Competitors can match specs—not operational insight.

The high margins and rapid growth in Credo's connectivity business will undoubtedly attract competition. Large, well-funded players like Broadcom and Marvell certainly possess the engineering talent to design highly competitive AECs, DSPs, or retimer ICs. They can look at Credo's datasheets and aim to match or exceed the specifications.

What they are likely missing, or at least significantly underestimating, is the compounding advantage Credo is building through Pilot and its real-world deployment data. We're talking about potentially three or more years of telemetry from diverse, cutting-edge hyperscaler AI deployments, all feeding into Pilot's algorithms and refining its predictive capabilities.

This isn't just about raw hardware performance; it's about understanding the subtle failure modes, the optimal tuning parameters, and the complex interplay of thousands of high-speed links in a live, petascale AI environment. When hyperscalers integrated Credo's solutions in 2022 and 2023, they weren't just buying connectivity hardware—they were participating in the development of AI infrastructure best practices.

That operational intelligence is now embedded in Pilot's algorithms. It represents thousands of hours of hyperscaler engineering time, millions of dollars in training run optimization, and countless lessons learned from real-world AI deployment challenges.

Credo's moat, therefore, isn't just better chips today; it's increasingly built on time, accumulated operational data, and the friction of deep customer workflow integration. Pilot isn't merely a feature on a datasheet; it's evolving into a system dependency for customers who rely on its intelligence to keep their multi-billion dollar AI factories running smoothly.

Furthermore, each successful hyperscaler deployment acts as a powerful reference. As one major cloud provider validates the operational benefits of Credo's integrated approach, it de-risks adoption for others, creating network effects. Competitors can offer alternative silicon, but they cannot easily replicate years of embedded operational learning and customer trust.

What the Market's Missing

Core Insight: The financials already point to a platform business—the multiple doesn't yet fully reflect it.

Credo's current forward P/E of ~53.6x reflects significant optimism for continued AI-driven growth but likely still values the company primarily as a high-growth semiconductor provider. The transformative upside—the Cisco-like re-rating—comes when the market fully recognizes and values the platform transformation.

Here's how the next three years could unfold:

Bull Case ($300-400, 4-5x returns by 2028)

· Market Realization: Investors fully grasp Credo's platform shift, re-rating it as a critical AI infrastructure platform provider, akin to high-growth infrastructure software companies.

· Financials: Revenue reaches $3-4 billion, driven by broad adoption across AEC, optical, and PCIe segments, with Pilot significantly enhancing ASPs and enabling new service revenues. Net margins expand to 50%+.

· Valuation: Achieves a 35-40x P/E multiple on significantly higher earnings, reflecting platform economics and recurring value creation.

· Catalyst: Pilot becomes a de facto standard for hyperscalers managing high-speed AI connectivity, with clear evidence of high switching costs and operational dependencies.

Base Case ($150-200, 2-2.5x returns)

· Hybrid Identity: Credo is recognized as an exceptionally strong AI hardware company with a growing, valuable software layer, but the full platform re-rating proves more gradual.

· Financials: Revenue grows to $2-2.5 billion with strong execution across product lines. Net margins solidify in the 40-45% range, demonstrating superior hardware-plus-software economics.

· Valuation: Commands a premium semiconductor/systems multiple of 30-35x P/E.

· Reality: Credo executes well, captures significant AI market share, and Pilot provides clear differentiation, but the market still primarily values the hardware cycles.

Bear Case ($20-40, 0.25-0.5x returns)

· Platform Stalls: The Pilot platform thesis fails to gain significant traction or differentiate meaningfully. Credo remains primarily a hardware vendor facing intensifying competition.

· Market Dynamics: The AI infrastructure boom cools, and/or intense competition from larger players or hyperscalers' in-house solutions erodes pricing power and market share.

· Financials: Revenue growth slows considerably after initial surge. Margins compress back toward traditional semiconductor levels (15-20%) as platform differentiation fails.

· Valuation: The market values Credo like a cyclical, competitive semiconductor company with a 15-20x P/E multiple.

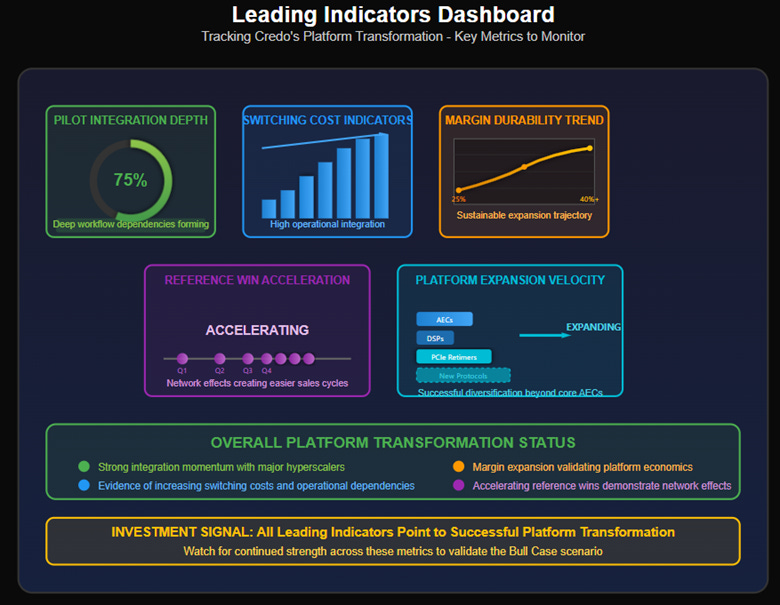

The Leading Indicators

· Core Insight: Early signal recognition of the platform transformation creates asymmetric upside.

· Tracking Credo's progress requires looking beyond headline revenue and EPS to platform-specific metrics:

· Pilot Deployment Density & Integration: Are customers actively referencing operational integration with Pilot beyond just hardware performance? Look for case studies highlighting Pilot's role in improving uptime, reducing OpEx, or accelerating deployments.

· Customer Switching Cost Evidence: As competitive solutions emerge, is there evidence of hyperscalers' reluctance to replace deployed Credo systems due to embedded Pilot intelligence and operational workflows?

· Expansion Velocity Beyond Core AECs: How successfully does Credo ramp PCIe retimers and support new protocols? This expansion increases their "surface area" within AI clusters and validates platform dynamics.

· Margin Durability and Expansion: Can Credo sustain and expand ~40%+ non-GAAP net margins as it scales? This would strongly validate software/platform value creation versus pure hardware economics.

· Reference Win Acceleration: Does each new major hyperscaler win make subsequent wins easier? Evidence of network effects where Pilot's intelligence improves with more deployment data would create self-reinforcing competitive advantages.

Completing the Arc

Just as Cisco's IOS transformed the company from a router vendor into the intelligent backbone of the internet, Credo's Pilot platform has the potential to transform them from a connectivity component supplier into the intelligent management layer for AI data fabrics.

History shows that owning the "intelligence layer"—the software and systems that manage and optimize critical infrastructure—has consistently yielded dominant market positions and superior long-term economics. Credo isn't just a plumbing company ensuring bits get from A to B; they are building a systems company, deeply embedded within the operational heart of AI infrastructure, making those connections smarter, more reliable, and more efficient.

They are, in essence, hiding a platform company inside a rapidly growing connectivity vendor.

Investment Implications

Core Insight: Traditional semiconductor analysis fundamentally misses the asymmetric payoff potential of a successful platform transition.

This isn't just a story about a good chip company capitalizing on the AI boom. The real investment thesis is about a platform transformation in motion, creating an asymmetric opportunity:

· Upside: If the platform thesis plays out and Credo becomes the "Cisco of AI connectivity," the potential for significant re-rating and sustained high-margin growth is substantial, as outlined in the Bull Case.

· Downside: If the platform thesis fails or AI market dynamics turn unfavorable, the stock could revert to valuations typical of a specialized but cyclical hardware company.

This suggests that for investors with a 12-18 month or longer time horizon, carefully considered position sizing could be attractive, especially ahead of broader market recognition of the platform potential. The key is monitoring execution milestones and leading indicators of this transformation.

The Intelligence Layer Thesis

In infrastructure revolutions, the winners don't lay the pipes—they make the pipes think.

Credo Technology is making a compelling case that it is not merely selling interconnects; it is selling operational intelligence for the mission-critical connectivity that underpins the entire AI revolution. The market, focused on GPU counts and model parameters, may still be predominantly valuing the copper and silicon.

Investors who look deeper and see the emerging software and intelligence layer—who understand that Credo is building the "IOS for AI data fabrics"—may be the ones to capture the most significant upside as this transformation unfolds.

Twenty-nine years ago, Cisco taught us that the most valuable infrastructure companies don't just move data—they make data movement intelligent. Credo appears to be applying that same lesson to the AI era. The question for investors is whether they'll recognize the pattern before everyone else does.

#AI #Semiconductors #Infrastructure #CredoTechnology #TechInvesting #PlatformShift #AIInfrastructure #CiscoMoment #DeepTech #GPUs #Connectivity #Hyperscalers #PilotPlatform CRDO 0.00%↑ ALAB 0.00%↑ AVGO 0.00%↑ NVDA 0.00%↑ SMH 0.00%↑ SOXX 0.00%↑

General Disclaimer: The information presented in this communication reflects the views of the author and does not necessarily represent the views of any other individual or organization. It is provided for informational purposes only and should not be construed as investment advice, a recommendation, an offer to sell, or a solicitation to buy any securities or financial products.

While the information is believed to be obtained from reliable sources, its accuracy, completeness, or timeliness cannot be guaranteed. No representation or warranty, express or implied, is made regarding the fairness or reliability of the information presented. Any opinions or estimates are subject to change without notice.

Past performance is not a reliable indicator of future performance. All investments carry risk, including the potential loss of principal. This communication does not consider the specific investment objectives, financial situation, or particular needs of any individual.

The author and any associated parties disclaim any liability for any direct or consequential loss arising from the use of this material and undertake no obligation to update or revise it.

Great write up, thanks. I've been telling people about crdo a bit but this is much more articulate than my "just trust me"