Inside the AI Gambit and the $138B Backlog – Why Oracle is Quietly Building the Toll Road for Enterprise AI

Why the Most Underestimated Player in the Cloud Wars Might Be Building the Most Valuable Chokepoint in Enterprise AI

I. Introduction: The Obvious Story vs. The Deeper Current

When Oracle's stock surged 13% following its Q4 earnings beat in June 2025, the headlines wrote themselves. "Oracle rides AI wave to record highs." "Database giant finally finds cloud momentum." The narrative was clean, familiar, and fundamentally incomplete.

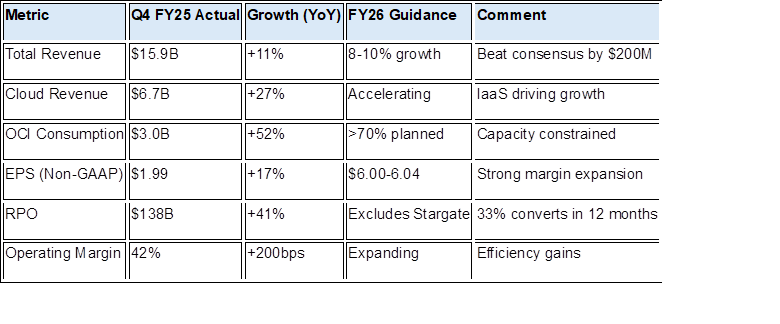

Yes, Oracle delivered a solid earnings beat with revenue growing 11% to $15.9 billion and cloud infrastructure revenue exploding 52% YoY. Yes, the company guided optimistically for fiscal 2026 with total revenue growth of 8-10% and cloud revenue acceleration. The market celebrated another AI beneficiary finding its footing in the cloud wars.

But to focus solely on Oracle "catching up" or being "another AI beneficiary" is to miss the far more audacious and potentially lucrative game being played. Oracle is not just riding the AI wave; they are engineering the indispensable AI Data Tollbooth for the enterprise, and the market is still largely looking at the paving equipment.

While competitors battle for raw compute market share, Oracle is quietly positioning itself as the essential intermediary between enterprise data and artificial intelligence—a strategic chokepoint that could reshape cloud competition and unlock significant long-term value far beyond what current multiples suggest.

II. Deconstructing the Quarter: The Numbers That Roared

2.1 The RPO Tsunami & The Guidance That Followed

The standout number isn't the revenue beat or even the 52% OCI growth—it's the $138 billion remaining performance obligation that towers over everything else. This backlog, representing contracted but unrecognized revenue, grew 41% YoY and notably excludes the massive Stargate partnership with Microsoft. With one-third expected to convert within 12 months, Oracle has unprecedented revenue visibility extending years into the future.

Forward guidance for fiscal 2026 signals management's confidence in execution. Total revenue growth of 8-10% might seem modest, but the composition tells a different story. Cloud infrastructure is expected to maintain growth above 70%, while total cloud revenue accelerates from current levels. More importantly, management emphasized that OCI demand "continues to dramatically outstrip supply," suggesting growth is capacity-constrained rather than demand-limited.

The capital expenditure story provides crucial context. Oracle plans to deploy $25+ billion in CapEx over the next few years, primarily for OCI infrastructure expansion. This represents one of the largest infrastructure investments in the company's history, reflecting both the scale of contracted demand and management's conviction in long-term returns.

2.2 Executive Soundbites & What They Really Mean

CEO Safra Catz's commentary revealed strategic priorities beyond the headline numbers: "The quality of our RPO has never been better. These are longer-term contracts with our largest customers who are making significant commitments to Oracle's infrastructure." This isn't just revenue deferral—it's evidence of enterprise customers making strategic bets on Oracle's AI infrastructure capabilities.

Executive Chairman Larry Ellison was characteristically direct about Oracle's differentiation: "Nobody else has what we have in terms of the AI Data Platform. We can take your private data, vectorize it in our database, and connect it directly to any large language model—ChatGPT, Grok, Gemini—without your proprietary information ever leaving your control."

The technical complexity of this statement belies its strategic importance: Oracle is positioning itself as the secure bridge between enterprise data and AI capabilities.

Perhaps most tellingly, Ellison emphasized that "inferencing is going to be a much bigger business than training" for Oracle. While competitors focus on expensive AI model training workloads, Oracle is betting on the higher-frequency, lower-latency inference workloads that will power day-to-day enterprise AI applications. This suggests a different margin profile and stickiness than pure compute plays.

2.3 Financial Undercurrents: Margin Trajectory & Capital Allocation

The financial quality beneath the growth numbers deserves attention. Operating margins expanded 200 basis points to 42%, demonstrating operational leverage even during a heavy investment phase. Oracle's cloud infrastructure gross margins remain undisclosed but management has indicated they expect significant improvement as specialized AI workloads scale.

The CapEx investment phase represents a calculated bet on demand durability. Unlike speculative infrastructure builds, Oracle's capacity expansion directly responds to contracted customer commitments reflected in the RPO. This demand-driven rather than supply-driven approach reduces traditional cloud infrastructure risks while positioning Oracle to capture premium pricing for scarce AI-optimized capacity.

Capital allocation priorities remain balanced despite the growth investment phase. Oracle maintained its quarterly dividend at $0.40 per share and continues share repurchase programs, signaling confidence that current investments won't compromise shareholder returns. The company's strong free cash flow generation—despite near-term CapEx pressures—provides flexibility to fund growth while returning cash to shareholders.

III. The Strategic Blueprint: Engineering the AI Data Tollbooth

3.1 The Database is Destiny, Reimagined for AI

Oracle's database franchise has generated cash flows for decades, but the AI era transforms this asset from a legacy stronghold into a strategic weapon. The company's database market share—estimated at 30-40% of enterprise database workloads—becomes the foundation for something much more valuable: control over how enterprises access AI capabilities.

Oracle 23AI in One Paragraph: Oracle's 23AI database vectorizes enterprise data and connects directly to LLMs like ChatGPT, Grok, or Gemini—without leaking proprietary information. It's a control point for enterprise inference and training, securely deployed across any cloud, making private data AI-ready while maintaining security and governance controls that enterprises demand.

This capability addresses the fundamental enterprise AI challenge: how to leverage large language models without exposing sensitive data. While cloud providers offer AI services, they typically require data to leave enterprise control. Oracle's approach keeps data within the customer's security perimeter while enabling AI functionality—a critical distinction for regulated industries and security-conscious enterprises.

The database-AI integration creates powerful network effects. As more enterprises deploy Oracle 23AI for AI workloads, Oracle gains insights into AI usage patterns, performance optimization, and security requirements that compound their competitive advantage. This data about data becomes increasingly valuable as AI adoption scales across the enterprise.

3.2 OCI: The Specialized AI Factory, Not Just Another Cloud

Oracle Cloud Infrastructure represents a fundamentally different approach to cloud computing—optimized for high-performance, specialized workloads rather than commodity compute. The Gen 2 architecture prioritizes network performance, security isolation, and compute density specifically for AI training and inference workloads.

The Stargate partnership with Microsoft exemplifies this strategy. Rather than competing directly with hyperscalers on breadth, Oracle focuses on depth in AI workloads while leveraging partner relationships for distribution. Stargate's planned $100+ billion investment validates Oracle's AI infrastructure approach while providing massive scale testing for OCI capabilities.

Oracle's "small footprint, big impact" advantage becomes crucial for specialized deployments. The company's ability to deploy meaningful AI capacity in just three racks (versus the warehouse-scale requirements of traditional hyperscalers) enables edge AI deployments, sovereign cloud solutions, and embedded enterprise installations that larger competitors struggle to address economically.

3.3 Multi-Cloud Mastery: Coopetition as a Distribution Weapon

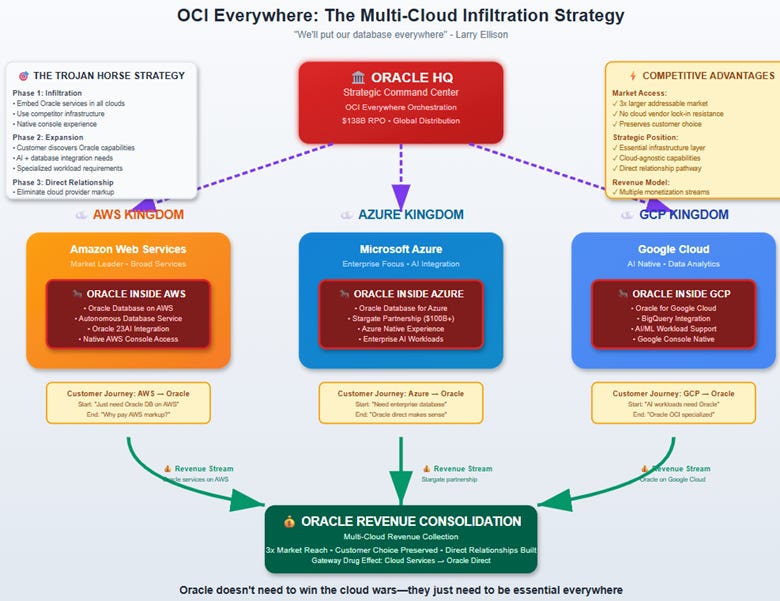

The "OCI Everywhere" strategy represents perhaps Oracle's most sophisticated competitive move. By embedding OCI capabilities within AWS, Microsoft Azure, and Google Cloud, Oracle transforms potential competitors into distribution channels while expanding the addressable market for Oracle's higher-value services.

This isn't defensive positioning—it's offensive strategy disguised as cooperation. Enterprises that start with Oracle database services on AWS often discover they need Oracle's AI capabilities, advanced security features, or specialized compute. The path from basic database hosting to comprehensive Oracle cloud services becomes frictionless when OCI components are already integrated within existing cloud environments.

The multi-cloud approach also addresses enterprise procurement realities. Rather than forcing customers to choose between Oracle and their existing cloud investments, Oracle enables both. This reduces switching costs, accelerates adoption, and positions Oracle services as complementary rather than competitive to existing cloud strategies.

3.4 SaaS Reborn: Applications as AI Agents

Oracle's software-as-a-service offerings—Fusion ERP and NetSuite—are being transformed from traditional enterprise applications into AI-powered business agents. This evolution moves beyond adding "AI features" to fundamentally reimagining how enterprise software operates.

Fusion and NetSuite applications increasingly automate routine business processes, provide predictive insights, and offer natural language interfaces for complex business operations. This transformation enhances customer stickiness while justifying premium pricing through productivity improvements rather than feature comparisons.

The SaaS AI integration creates powerful cross-selling opportunities. Customers using Oracle's AI-enhanced applications naturally consume more database and infrastructure services as their AI usage expands. This integrated approach contrasts with point-solution AI tools that lack enterprise application context and database integration.

IV. Market Perception vs. Variant Reality

4.1 What Wall Street Sees (And What It's Still Processing)

Current market consensus views Oracle positively but within familiar frameworks. Analysts appreciate the cloud growth acceleration, strong AI demand, and improving margins, but many still categorize Oracle as a "legacy tech turnaround" rather than an AI infrastructure innovator. The forward P/E of approximately 26x reflects optimism about growth but not the premium multiples accorded to pure-play AI infrastructure companies.

Recent analyst upgrades from UBS (to $225) and Goldman Sachs (to $195) demonstrate growing conviction in Oracle's cloud strategy, but the price targets suggest incremental rather than transformational change expectations. The investment community recognizes Oracle's improved execution but hasn't fully embraced the strategic repositioning toward AI infrastructure leadership.

Valuation multiples reveal this gap between perception and potential. While Oracle trades at reasonable multiples for a cloud-transitioning enterprise software company, it doesn't command the premium accorded to essential AI infrastructure providers. This disconnect creates opportunity for investors who understand Oracle's unique positioning in the AI value chain.

4.2 The Variant Angle: Beyond IaaS Growth – The Enterprise AI Data Layer

The market fundamentally misunderstands Oracle's strategic position. While investors focus on cloud infrastructure growth rates and competitive positioning against AWS or Microsoft, they miss Oracle's unique role as the essential data layer for enterprise AI. Oracle isn't just another cloud provider—it's becoming the critical infrastructure that enables enterprises to use AI safely and effectively.

Three specific market misperceptions create this opportunity:

· Anchoring Bias: Investors remain anchored to Oracle's legacy database business model, viewing AI capabilities as incremental features rather than fundamental business transformation. The market hasn't recognized that Oracle's database dominance becomes exponentially more valuable in an AI-driven world.

· Complexity Discount: Oracle's multi-layered AI strategy (database + infrastructure + applications + multi-cloud) is harder to understand than simple "cloud revenue growth" narratives. Complex strategies often trade at discounts until results prove their effectiveness.

· Cloud Wars Framing: The market views cloud competition through market share and commodity pricing, missing Oracle's differentiated positioning as the secure AI data layer rather than a general-purpose compute provider.

The variant perception centers on Oracle's emerging role as the "enterprise AI data backbone"—the essential infrastructure layer that sits between enterprise data and AI capabilities across all clouds. This positioning could generate higher margins, greater stickiness, and more defensive competitive positioning than traditional cloud infrastructure.

V. The Crystal Ball: Scenarios for Oracle in 2028

5.1 The Bull Case: AI Data Dominance – The Tollbooth is Printing (35% probability)

Potential Valuation Range: 55-80% premium to current levels

Key Drivers: Flawless OCI execution establishes Oracle as the preferred AI infrastructure provider for enterprises. The AI Data Platform becomes the industry standard for secure enterprise AI deployment. Multi-cloud strategy creates true platform synergy, with Oracle services deeply embedded across AWS, Azure, and Google. Stargate success catalyzes broader AI infrastructure adoption beyond the Microsoft partnership. Operating margins expand significantly as specialized AI workloads achieve scale economics.

Financial Snapshot: Revenue reaches $85B+ by fiscal 2028, driven by 25%+ annual cloud growth and accelerating SaaS adoption. EPS grows at 20%+ CAGR as margin expansion accompanies revenue growth. The market re-rates Oracle's P/E to 30-35x, reflecting recognition as essential AI infrastructure rather than legacy software.

This scenario assumes Oracle successfully executes on its most ambitious strategic goals. The AI Data Platform becomes the de facto standard for enterprise AI deployment, creating powerful network effects and pricing power. OCI capacity scales efficiently to meet demand while achieving target gross margins above 60%. The company's multi-cloud strategy reaches full potential, with Oracle services generating significant revenue across competitor platforms.

5.2 The Base Case: Solid Execution, Significant AI Player (45% probability)

Potential Valuation Range: 10-35% premium to current levels

Execution Requirements: Oracle meets current strong guidance with total revenue growth sustaining 8-10% annually. OCI capacity scales effectively to support 50%+ annual growth while achieving reasonable margins. AI Data Platform adoption proceeds steadily among enterprise customers without achieving dominant market position. Margin improvement continues at modest pace as operational leverage takes effect.

Financial Snapshot: Revenue reaches $75-80B by fiscal 2028, representing solid execution on current trajectory. EPS grows 15-18% annually through combined revenue growth and margin expansion. P/E multiple remains in 25-28x range, reflecting successful cloud transition without premium AI infrastructure valuation.

This scenario represents successful execution of Oracle's current strategy without extraordinary outcomes. The company becomes a significant player in enterprise AI infrastructure while maintaining its database leadership. Growth continues at attractive rates without achieving the transformational scale suggested by the bull case.

5.3 The Bear Case: Execution Stumbles, AI Competition Intensifies (20% probability)

Potential Valuation Range: 20-30% discount to current levels

Risk Factors Materialize: OCI capacity build-out fails to meet demand, creating customer satisfaction issues and competitive disadvantage. Hyperscalers successfully counter Oracle's AI Data Platform with integrated alternatives that reduce Oracle's differentiation. AI workload margins disappoint as competition intensifies and specialized positioning erodes. Broader enterprise AI investment slows, reducing demand for Oracle's premium services.

Financial Snapshot: Revenue struggles to significantly exceed $70B by fiscal 2028, representing deceleration from current growth trajectory. EPS growth falls below 10% annually as margin pressures offset revenue gains. P/E multiple contracts to sub-20x as market treats Oracle as mature enterprise software rather than growth technology.

The bear case assumes Oracle fails to execute on its AI infrastructure strategy while facing intensified competition. The company's database business remains stable but growth opportunities disappoint. Capital allocation during the investment phase fails to generate expected returns, leading to shareholder return pressure.

VI. Pivotal Factors & Risk Assessment: The Tightrope Walk to AI Supremacy

6.1 Key Success Factors (The Upside Levers)

· Flawless OCI Capacity Build-out: Oracle's ability to deploy $25+ billion in CapEx efficiently while meeting customer demand requirements will determine whether current RPO converts into sustainable revenue growth. Supply chain management, data center construction, and GPU procurement execution become critical operational capabilities.

· AI Data Platform Market Adoption: The speed and breadth of Oracle 23AI adoption among enterprise customers will determine whether Oracle achieves its vision of becoming the essential AI data layer. Success requires not just technical capability but also enterprise sales execution and customer success management.

· Margin Profile Achievement: Oracle's ability to achieve target gross margins above 60% for OCI services while maintaining competitive pricing will determine profitability potential. This requires operational efficiency, automation, and premium service positioning.

· Technological Leadership Maintenance: Continued innovation in database-AI integration, multi-cloud capabilities, and specialized infrastructure will determine Oracle's competitive moat durability. R&D investment effectiveness and technical talent retention become crucial success factors.

6.2 Key Risks & Headwinds (What Could Derail the Thesis)

· Execution Risk at Scale: Oracle's largest risk remains operational execution during rapid growth. CapEx deployment, customer onboarding, and service delivery at unprecedented scale create multiple failure points that could damage customer relationships and competitive positioning.

· Hyperscaler Competitive Response: AWS, Microsoft, and Google possess significant resources and could develop integrated AI data solutions that compete directly with Oracle's differentiated positioning. Their broader platform integration and pricing power represent existential competitive threats.

· AI Market Evolution: The enterprise AI market remains nascent and could evolve in directions that reduce Oracle's advantages. Open-source alternatives, commoditization of AI infrastructure, or shifts toward edge computing could undermine Oracle's centralized AI data platform strategy.

· Economic Cyclicality: Enterprise AI investment could prove more cyclical than currently expected. Economic downturns, capital allocation shifts, or AI productivity disappointments could reduce demand for Oracle's premium-priced specialized services.

6.3 Monitoring Dashboard: KPIs to Watch

· Quarterly Metrics: OCI consumption growth rates, RPO conversion efficiency, AI Data Platform customer acquisition, and OCI gross margin progression provide essential health indicators for Oracle's strategic transformation.

· Annual Assessments: Multi-cloud deployment breadth, Stargate partnership expansion, competitive win rates against hyperscalers, and customer retention for AI workloads indicate long-term strategic progress.

· Thesis Invalidation Signals: OCI growth deceleration below 30%, significant customer losses to competitive alternatives, margin compression despite scale benefits, or management guidance reductions would suggest fundamental strategy challenges requiring investment thesis reassessment.

VII. Conclusion: The Oracle Thesis – Investing in the AI Data Backbone

Oracle's transformation from legacy database vendor to AI infrastructure provider represents one of the most ambitious strategic repositioning efforts in enterprise technology. While the market celebrates Oracle's cloud growth, it hasn't fully recognized the company's unique positioning as the essential bridge between enterprise data and artificial intelligence capabilities.

The investment case combines Oracle's enduring database strengths with innovative AI infrastructure and strategic multi-cloud positioning. This isn't just about joining the AI revolution—it's about controlling a critical chokepoint in how enterprises access and deploy AI capabilities securely and effectively.

If Oracle executes flawlessly, we're looking at a stock with significant upside toward $300+. If it stumbles on its AI capacity and data platform strategy, a retreat toward the $150s becomes plausible. The wide range of outcomes reflects both the opportunity and risk inherent in Oracle's ambitious strategy.

The true test will be the sustained conversion of its monumental $138 billion RPO into high-margin cloud revenue over the next 12-24 months. Oracle CloudWorld in October will provide a key checkpoint for management to update investors on capacity build-out progress and early AI Data Platform traction among enterprise customers.

Oracle's thesis ultimately depends on the enterprise world's embrace of AI and the company's execution in becoming the indispensable infrastructure provider for that transformation. For investors willing to bet on both trends, Oracle offers a unique combination of defensive database cash flows and offensive AI infrastructure growth—a rare investment profile in today's technology landscape.

The AI revolution needs enterprise data to reach its potential. Oracle is building the tollbooth that every AI application must pass through to access that data securely. Whether that tollbooth becomes essential infrastructure or expensive plumbing will

#InferenceEconomy #VariantPerception #AIDataPlatform #LinkedInTech ORCL 0.00%↑ IGV 0.00%↑ SMH 0.00%↑ SOXX 0.00%↑