Sea Limited 1Q25 Earnings: Three Engines, One Flywheel

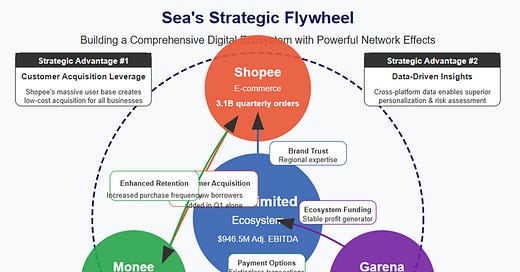

Shopee, Monee, and Garena are no longer separate stories. Q1 2025 proves the power of Sea’s unified ecosystem as profitability and growth finally move in lockstep.

From Bloomberg - “Sea Ltd. reported profit that topped analysts’ estimates, a sign that the Southeast Asian e-commerce leader is holding up well against fierce rivals TikTok and Lazada.

The stock jumped as much as 10% in US pre-market trading after Sea reported net income of $410.8 million for the first quarter through March, compared with a year-earlier loss. Analysts predicted $353.4 million on average. Sales climbed 30% to $4.84 billion, roughly in line with estimates.

The results suggest online retail arm Shopee is having success fending off ByteDance Ltd.’s TikTok and Alibaba Group Holding Ltd.’s Lazada across Southeast Asia. Newer contenders like Shein and PDD Holdings Inc.’s Temu are also targeting the region of more than 675 million people, where more shoppers are moving online. In a display of its strength, Shopee has been steadily raising the commissions it charges merchants in many core markets by about a third since the start of last year.”

I've been watching Sea Limited for years now, and this quarter represents the full realization of the company's long-promised triple-threat business model. While plenty of investors and analysts (myself included) have questioned whether Sea could successfully operate three distinct businesses that truly complement each other, Q1 2025 delivers emphatic proof that the strategy is working. The bottom-line outperformance is staggering: adjusted EBITDA at $946.5 million, nearly 44% above analyst estimates, with all three business segments contributing meaningfully to both growth and profitability.

The Three-Headed Growth Machine Roars

What makes this quarter particularly striking is how each of Sea's core businesses is now operating at scale while substantially improving profitability. This isn't just about one segment carrying the others anymore – it's about complementary growth engines that are starting to feed each other in increasingly meaningful ways.

Shopee's transformation from cash-burner to profit engine marks the true turning point for Sea. The business has gone from losing $21.7 million in Q1 2024 to generating $264.4 million in adjusted EBITDA – a swing of $286 million YoY. This validates the thesis that Sea could leverage its gaming profits to build an e-commerce juggernaut that would eventually stand on its own two feet.

The most telling metric here is Shopee's adjusted EBITDA as a percentage of GMV, which hit 0.9% (up from -0.1% a year ago). On the earnings call, management reiterated their confidence in reaching a 2-3% long-term target. If they hit the midpoint of that range, Shopee alone would generate nearly $800 million in quarterly adjusted EBITDA at current GMV levels – without any additional growth.

Speaking of growth, Shopee delivered 21.5% GMV growth and 20.5% order growth YoY. This continued expansion while improving profitability speaks to a business that has found the elusive balance between growth and efficiency. Management emphasized three operational priorities – price competitiveness, service quality, and content ecosystem enhancement – with measurable progress on all fronts.

Chris Feng detailed on the call that this improvement came through "better take rate, better cost structure, and just better operations," showing that Sea no longer needs to buy growth at all costs. They've achieved the scale and market position to extract more value from their existing ecosystem.

Garena's Unexpected Renaissance

The biggest surprise in Sea's earnings comes from Garena. Free Fire, now approaching its eighth year, delivered its strongest performance since 2021, with bookings up an astonishing 51.4% YoY to $775.4 million. This completely defies the normal lifecycle of mobile games, which typically peak after 2-3 years and then gradually decline.

What's driving this renaissance? The collaborative power of IP partnerships, evidenced by the phenomenal success of Free Fire's NARUTO SHIPPUDEN collaboration in January. But what's most impressive isn't just that they're maintaining their audience – they're dramatically improving monetization:

Quarterly active users up 11.3% YoY to 661.8M

Quarterly paying users up 32.2% YoY to 64.6M

Paying user ratio increased to 9.8% (vs. 8.2% YoY)

Average bookings per user rose to $1.17 (vs. $0.86 YoY)

Forrest Li noted on the call that the NARUTO collaboration was "a resounding success" that brought Free Fire's average DAU "close to its peak quarterly average DAU during the pandemic." This is remarkable for a game of this age and speaks to Sea's expertise in content strategy and community engagement.

There's a subtle shift happening in Sea's gaming approach: rather than desperately chasing new blockbuster hits (always high-risk), they're extending the life of their established franchise while carefully expanding with titles like Delta Force Mobile (which has already crossed 10 million downloads) and the upcoming Free City.

The Strategic Significance of the "Monee" Rebrand

The rebranding of SeaMoney to Monee might seem like a marketing triviality, but it signals a much more important strategic evolution. By creating a more distinct brand identity while maintaining clear ties to Shopee ("Monee also resonates well with the name of its sister brand, Shopee"), Sea is positioning its financial services as both an integrated part of its ecosystem and a standalone growth engine.

The numbers certainly support this dual-track vision:

Revenue up 57.6% YoY to $787.1M

Adjusted EBITDA up 62.4% YoY to $241.4M

Consumer & SME loans outstanding up 76.5% YoY to $5.8B

Active loan users exceeded 28M (up >50% YoY)

They added >4M first-time borrowers in Q1 alone

What's particularly impressive is that Sea has maintained a stable NPL ratio of 1.1% while aggressively growing the loan book by over 75% YoY. This suggests that Sea's data advantage from its e-commerce and gaming ecosystems is providing meaningful risk assessment benefits that other standalone fintech players can't match.

Forrest Li's emphasis that "risk management remains our top priority" and their goal to grow "in a way that is resilient to credit cycles" indicates that Sea has learned from the fintech boom-and-bust cycles we've seen globally. They're building this business for durability, not just growth.

I found it telling when Tony Ho mentioned on the call that they prefer to "diversify our source of fundings" rather than simply using their own cash, exploring "channeling arrangement and including like, even we explore some structure product like the ABS." This demonstrates a level of financial sophistication that transcends just bolting lending onto an e-commerce platform.

The Real Strategic Implications

Looking at Sea's business holistically, what's emerging is a comprehensive digital ecosystem with powerful network effects that will be increasingly difficult for competitors to challenge.

Three insights stand out:

Customer acquisition leverage: Shopee's 3.1 billion quarterly orders create an enormous funnel for both Monee and Garena, dramatically lowering customer acquisition costs across the entire business. This is evident in the 4 million new borrowers Monee added in Q1 alone.

Data-driven competitive advantages: The cross-platform data from e-commerce, financial services, and gaming gives Sea unparalleled insights for personalization, risk assessment, and content development. This explains how they've maintained stable credit quality despite 76.5% loan book growth.

Geographic diversification with localization excellence: Sea has mastered the difficult balance of scale and local relevance across Southeast Asia and Brazil. Local initiatives like Free Fire's Ramadan charity event in Indonesia demonstrate how they're embedding themselves culturally in ways pure global players cannot.

What's particularly notable about Sea's approach to spending is their relative discipline. Sales and marketing expenses grew by only 20.8% YoY, significantly lower than revenue growth of 29.6%. R&D expenses actually decreased by 2.8% YoY. This suggests Sea is becoming more efficient with its spending, focusing on high-ROI initiatives rather than simply throwing money at growth.

While TikTok Shop's recent launch in Brazil was mentioned on the call, management appeared unfazed, emphasizing their price advantages and logistics infrastructure. Chris Feng noted that the "livestream behavior as we see right now is probably not as prominent as we have seen in the Asia market," suggesting Sea isn't overly concerned about TikTok's content-commerce integration model disrupting their Brazil expansion.

For investors, the path is clearer than ever: Sea has successfully built three category-leading businesses that are now collectively profitable and still growing at impressive rates. The flywheel effects between these businesses are accelerating, with each segment strengthening the others. Shopee drives user acquisition for Monee, Monee drives retention and transaction frequency for Shopee, and Garena provides entertainment value to users and helps fund expansion across the ecosystem.

Management's relatively conservative guidance – ~20% GMV growth for Shopee, loan book growth "meaningfully faster" than that for Monee, and double-digit growth for Garena – now looks eminently achievable, if not beatable. The "Sea of Red" has transformed into a sea of green, and the company's position as the dominant digital economy platform in Southeast Asia and Brazil looks more secure than ever.

#SeaLimited #Shopee #Garena #Monee #Earnings #Growth SE 0.00%↑